Federal estimated tax payments 2021 online

How to Pay Estimated Taxes. Make Business Payments or Schedule Estimated Payments with the Electronic Federal Tax Payment System EFTPS For businesses tax professionals and individuals.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

As a partner you can pay the estimated tax by.

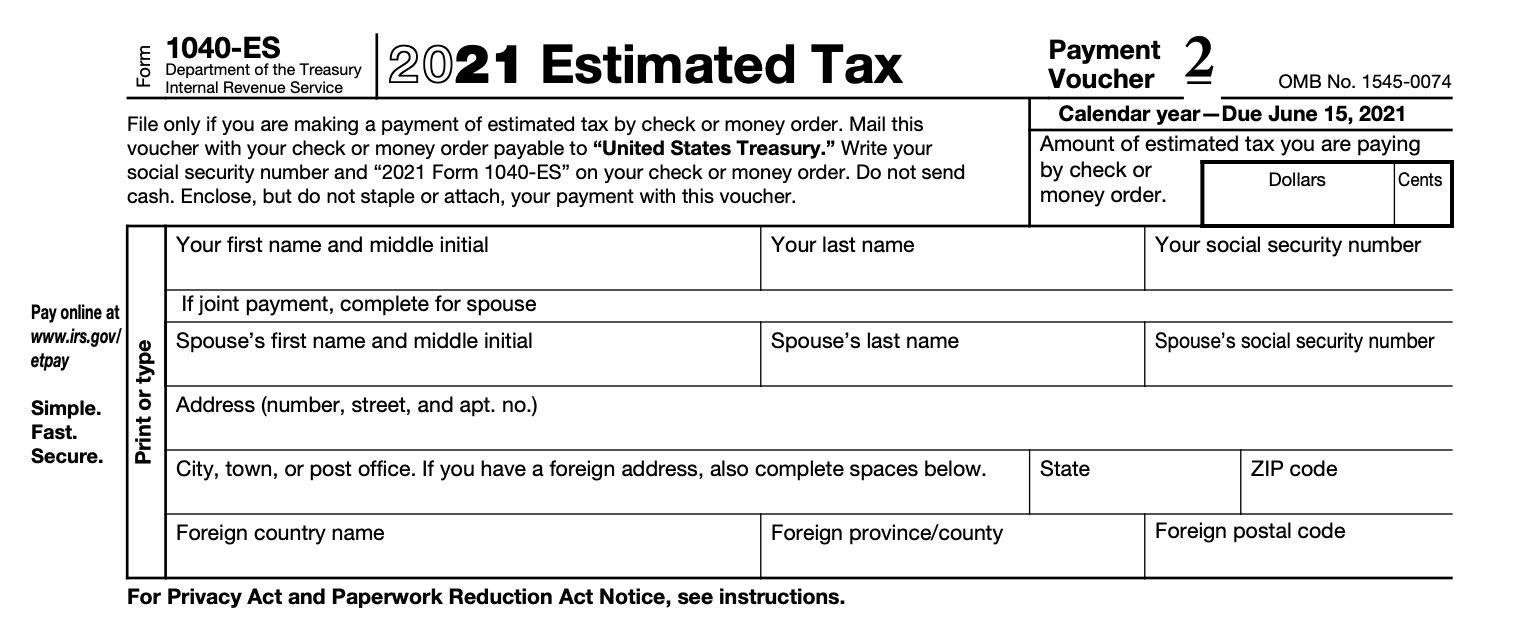

. The next estimated quarterly tax due date is Sept. Use Form 1040-ES to figure and pay your estimated tax for 2021. Use Form 1040-ES to figure and pay your estimated tax for 2022.

1040 Tax Estimation Calculator for 2021 Taxes. Premium Online Tax Filing. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022.

You can always make a tax payment by calling our voice response system at 18005553453. Based on your projected tax withholding for the. Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021.

The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. How do I make federal quarterly estimated payments. Once you have an EFTPS account established you can schedule automatic.

Based On Circumstances You May Already Qualify For Tax Relief. Quickly Prepare and File Your 2021 Tax Return. Electing To Apply a 2020 Return Overpayment.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. Quarterly tax payments should be made four times per year and the IRS does have guidelines or deadlines for these timeframes. These were as follows for 2021 Taxes these.

The IRS in Bulletin IR-2022-101 stated that multiple advantages exist for taxpayers who file estimated tax payments online. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. You may credit an overpayment.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. The deadline to file and pay your 2021 estimated taxes has passed. You may make estimated tax payments for tax year 2022 using New York State-approved commercial software.

For information on how to compute California estimated tax payments. You have a range of options for submitting estimated tax payments. Estimated Tax for Individuals.

Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. The last day to pay is June 15th. To make estimated tax payments online first establish an account with the IRS at the EFTPS website.

Apply your 2021 refund to your 2022 estimated tax. Use the Electronic Federal Tax Payment System EFTPS to. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

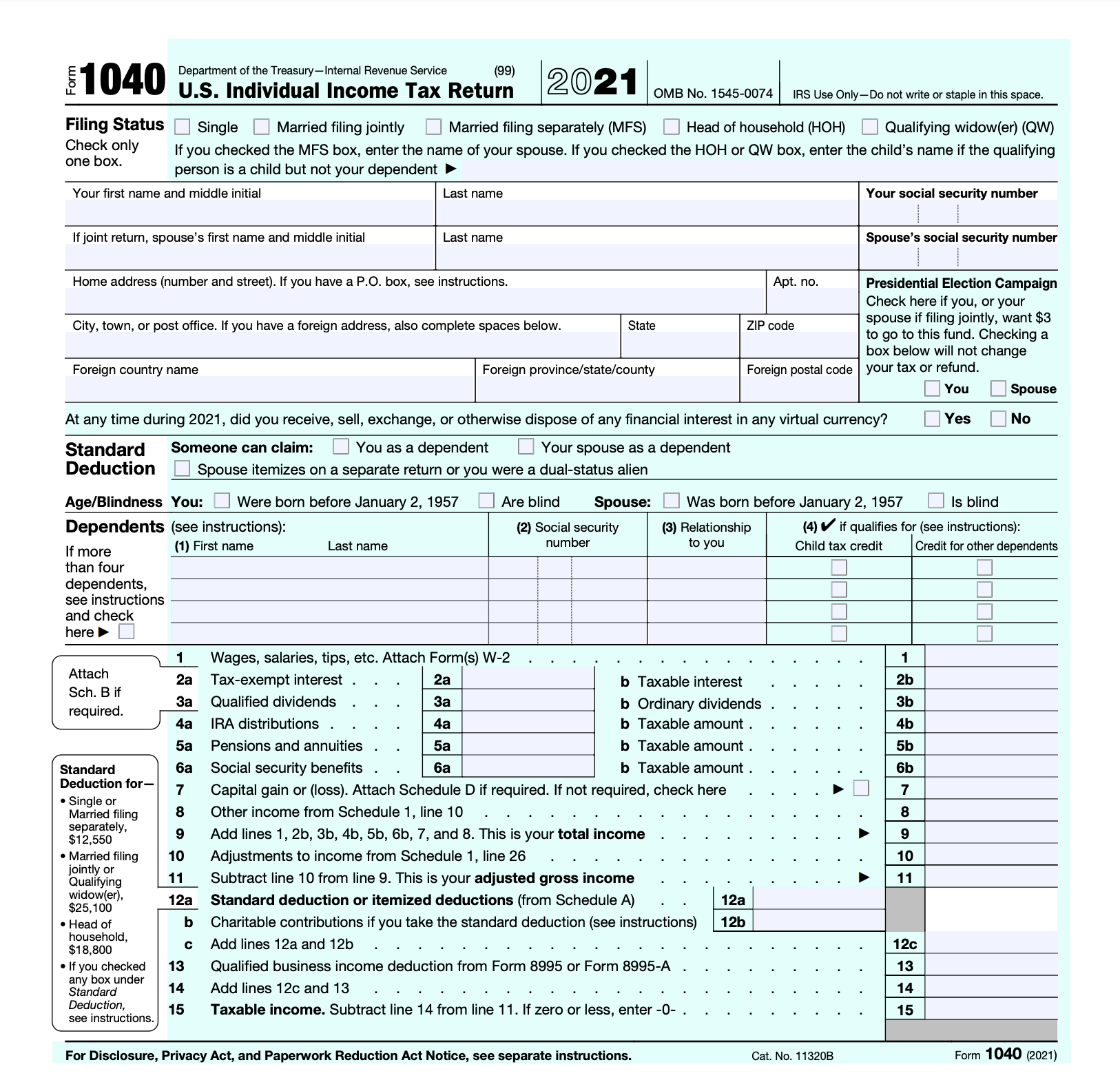

Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings. The IRS provides various methods for making 2022 quarterly estimated tax payments. Enter your filing status income deductions and credits and we will estimate your total taxes.

Making estimated tax payments online. If you dont pay. 425 57 votes The deadline for making a payment for the fourth quarter of.

You cant pay your 2021 taxes online until after this date. Crediting an overpayment on your. 2021 Tax Return Filing Online.

Its faster easier and it. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more. E-file your taxes directly to the IRS.

Using a Social Security Number SSN or Individual Taxpayer Identification Number ITIN When Paying Your Estimated Taxes-- 28-JUNE-2021. How do I pay my 2021 estimated taxes online. Income taxes are pay-as-you-go.

Ad From Simple to Advanced Taxes. Your tax payment is due regardless of this Web sites availability. One notable exception is if the 15th falls on a.

Pay online by debit or credit card for a small. To avoid a penalty your client must pay on or before the due dates. See E-file-approved commercial software.

Make your tax payment from. Mail a check or money order with Form 1040-ES.

2

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Solved How Do You Categorize An Estimated Tax Payment On Qb I Know It S Not An Expense What Is It

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Estimated Income Tax Payments For 2022 And 2023 Pay Online

When Are Taxes Due In 2022 Forbes Advisor

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

Fillable Form 1040 Individual Income Tax Return 2022 Blank Pdfliner

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

What Happens If You Miss A Quarterly Estimated Tax Payment

Estimated Tax Payments Youtube

Quarterly Tax Calculator Calculate Estimated Taxes

In A Letter The Aicpa Asked The Irs To Postpone Until June 15 2021 All 2020 Federal Income Tax And Information Returns A Tax Deadline Federal Income Tax Tax

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet